Align your budget with your mission

Cost containment strategies are designed to support your most vital financial processes, aid in managing your labor spend, demonstrate your finances, reflect your strategic plan, and prepare for future institutional peaks and valleys. Ensure your investments, annual budget, workforce allocation, and accreditation preparation are in order through valuable data readily available to board members, accreditors, and other key stakeholders.

Better informed, better aligned, better results

Data-based demonstrations

Provide your key stakeholders—board members, accreditors, and more—with tangible evidence across the institutional areas of highest focus. Informed annual budgets, tactical workforce allocation, and aligned strategic planning draw direct connections between choices and their financial impacts on enrollment, retention, and other vital outcome metrics.

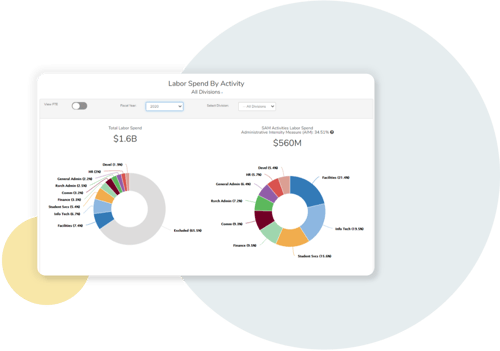

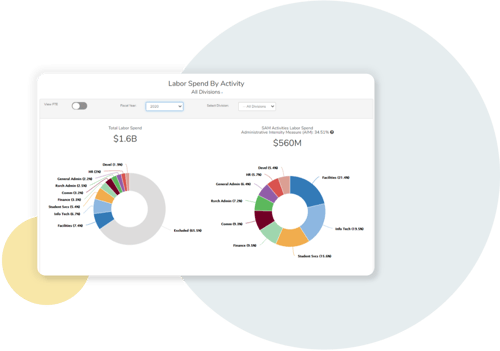

Empowered employment

Calibrate labor spend to line up with your institution’s goals and initiatives. Your staffing plans need to reflect strategic goals, and you’ll need data to help Human Resources and other departmental heads to reimagine roles, find areas for automation, and identify new operational opportunities as hiring markets continue to evolve, like increased competitiveness for IT roles.

Consolidate causes

Bring your financial practices into alignment with your mission and strategic planning initiatives. Providing evidence your institution can operate in-step with its loftiest ideals not only unites mission with action, it also bolsters the efforts necessary for reaccreditation. Demonstrate quality financial stewardship, as well as proof of institutional sustainability during a time of industry-wide uncertainty.

Adapt and advance

Proactively prepare for the inevitable ups and downs of higher education. Financial circumstances ebb and flow and, by informing cost containment strategies through deep data, your institution can anticipate impacts, alter course accordingly, and maneuver with a higher degree of certainty. Move from financial reports that only report on what’s already happened to active analytics which can help advise knowledgeable next steps.

Ask questions that align cost containment strategies with strategic planning

-

Where are we over- or under-staffed compared to best practices?

-

Is our institution spending competitively to recruit and retain top-level staff?

-

How can we staff-up to support our expanding student population and/or expanding research budgets?

-

What is the right level of centralization for a RCM school?

-

How lean and centralized is my institution from an administrative perspective compared to best practices?

-

Is it possible to realign administrative resources to combat bloat?

-

Are we managing assets and costs in alignment with institutional strategy?

-

Do operating results indicate the institution is living within available resources?

-

How does labor investment translate into student success?

-

Are we investing enough and in the right revenue-generating functions and activities?

-

How can we identify opportunities for staffing efficiencies and investments?

-

How are our investments and cost containment strategies demonstrating long-term sustainability in a way accreditors will value?

Combine cost containment strategies and institutional goals

Find out how HelioCampus Financial Intelligence solutions can help you uncover insights related to contribution margins, instructor utilization, and course delivery and demand. Become your own consultant with ongoing access to reliable data that informs staffing and scheduling efficiencies or competitive course offerings in-line with current and future demand.

Optimize your institutional budget

Benchmark labor costs

Benchmarking Consortium

Get a deep dive into labor allocation and costs when you analyze against job description criteria, not just department or function. We enable you to strategize ongoing workforce investments and initiatives to have more data-informed financial planning discussions with HR and department leaders.

-

Manage labor spend to contain costs or make strategic investments

-

Inform key financial processes, like annual budgeting, resource or strategic planning, with more precise data

-

Evaluate alignment with your strategic plan to demonstrate good financial stewardship and sustainability

Uncover academic programming opportunities

Academic Performance Management

Understand and manage the cost of instruction for your institution so you can better address budget deficits, identify efficiencies, and optimize faculty assignments and non-teaching activities.

- Gain visibility into instructional costs and margins to inform academic planning

- Identify trends in course demand or enrollment within academic departments

- Maximize instructor capability across teaching and non-teaching activities

Benchmark labor costs

Benchmarking Consortium

Get a deep dive into labor allocation and costs when you analyze against job description criteria, not just department or function. We enable you to strategize ongoing workforce investments and initiatives to have more data-informed financial planning discussions with HR and department leaders.

-

Manage labor spend to contain costs or make strategic investments

-

Inform key financial processes, like annual budgeting, resource or strategic planning, with more precise data

-

Evaluate alignment with your strategic plan to demonstrate good financial stewardship and sustainability

Uncover academic programming opportunities

Academic Performance Management

Understand and manage the cost of instruction for your institution so you can better address budget deficits, identify efficiencies, and optimize faculty assignments and non-teaching activities.

- Gain visibility into instructional costs and margins to inform academic planning

- Identify trends in course demand or enrollment within academic departments

- Maximize instructor capability across teaching and non-teaching activities

Request a Demo

HelioCampus gives you a clear line of sight into financial risks and opportunities within your institution related to labor costs, long-term financial sustainability, and alignment with your strategic plan. Let us help you uncover unseen trends and insights that can inform your annual planning, budget cycles, and workforce planning.

.png)