Trusted by

WHY COST ANALYTICS FOR HIGHER ED

Manage expenses, two ways

With today's high stakes, you need the right data at the ready to proactively lead your institution toward financial sustainability. When you rely on your ERP or complicated Excel formulas, your data remains siloed and lacks precision. Cost Analytics enables you to provide your campus with a deeper understanding of your major cost drivers–labor and academic programs–so you can make smarter decisions in-line with your mission.

Get financial clarity you can act on

Modernize your approach to labor and academic costs with a more in depth view of your financial data. Our team of expert analysts help you uncover the data you need to act early and ongoing, so you can support what matters most.

Transform financial planning

Labor Cost Analytics

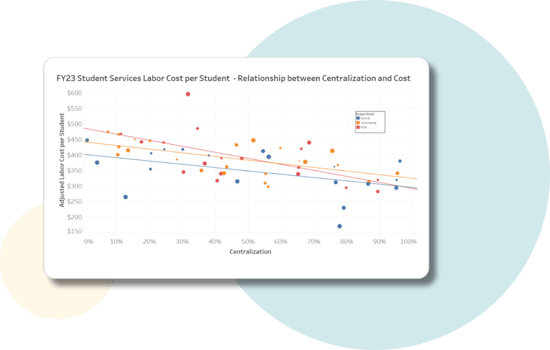

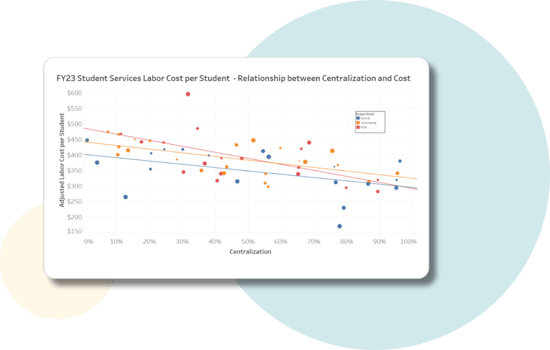

Shine a light on hidden costs within your staffing. When institutions look beyond traditional org structures to an activity-based approach, they're able to calculate the true cost to perform job functions and services. This lens provides a more nuanced view of your workforce to help identify areas to invest, efficiency leaks, and centralization opportunities.

-

Understand and evaluate administrative spend in any model–centralized or decentralized.

-

Support student success with the insights you need to assess quality and costs.

- Help HR optimize staffing costs when considering hiring requests, employee retention efforts, and succession planning.

- Benchmark your labor costs and uncover comparisons with our member institutions or internally to guide priorities.

See the full financial picture of every academic program

Academic Cost Analytics

Transform complex, siloed cost data into clear insights that you can put into practice. Give leaders the data they need to promote course efficiency, optimize faculty workloads, and create informed roadmaps for program expansion or consolidation.

-

Manage instructor activity to effectively deploy faculty.

-

Optimize course scheduling and pinpoint efficiencies in alignment with student demand.

-

Calculate contribution margin so you can better manage your program portfolio.

- Build scenarios for expense reduction.

.png?width=550&height=350&name=Untitled%20design%20(49).png)

Transform financial planning

Labor Cost Analytics

Shine a light on hidden costs within your staffing. When institutions look beyond traditional org structures to an activity-based approach, they're able to calculate the true cost to perform job functions and services. This lens provides a more nuanced view of your workforce to help identify areas to invest, efficiency leaks, and centralization opportunities.

-

Understand and evaluate administrative spend in any model–centralized or decentralized.

-

Support student success with the insights you need to assess quality and costs.

- Help HR optimize staffing costs when considering hiring requests, employee retention efforts, and succession planning.

- Benchmark your labor costs and uncover comparisons with our member institutions or internally to guide priorities.

See the full financial picture of every academic program

Academic Cost Analytics

Transform complex, siloed cost data into clear insights that you can put into practice. Give leaders the data they need to promote course efficiency, optimize faculty workloads, and create informed roadmaps for program expansion or consolidation.

-

Manage instructor activity to effectively deploy faculty.

-

Optimize course scheduling and pinpoint efficiencies in alignment with student demand.

-

Calculate contribution margin so you can better manage your program portfolio.

- Build scenarios for expense reduction.

.png?width=550&height=350&name=Untitled%20design%20(49).png)

Why HelioCampus?

Higher Ed Data Models

Our tested and proven data models save you time and resources building in-house. We create intuitive, logical relationships leveraged by many institutions, with flexible customizations for what makes your institution unique.

Analytics-First

Our financial products and services remove data siloes from your HRIS, ERP, payroll software, and more. Our analysis helps you build a more complete picture of your costs so you can manage expenses with greater precision and nuance.

Our HelioCampus Community

Discussing institutional finances can be difficult in the best of times. When you work with HelioCampus, you join our community of data-driven change agents, motivated to solve similar high stakes challenges on their campuses.

Confidence in Practice:

Finance Edition

What gets measured, gets managed. Join us for a new webinar series exploring your two largest expenditures–labor and academics–as levers for cost savings and optimization. We’ll look at real-life scenarios, strategies to navigate polarizing conversations, & discuss the tough decisions coming with increased regulatory pressures and funding shifts.

See HelioCampus Cost Analytics in action

Better data, smarter investments

Associate Vice President for Budget & Planning at Temple University Jaison Kurichi shares how HelioCampus helps them shine a light on hidden costs so they can make smarter investments and avoid across-the-board reductions.

.png)